Where Do Tech VCs Invest?

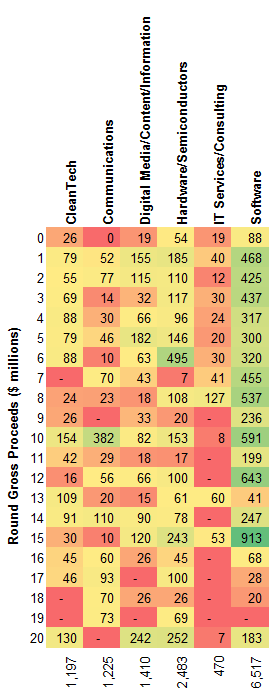

I was just playing around with another CompStudy data set and came up with the interesting chart at the right which I wanted to share. The chart attempts to answer the question, “where do tech VCs invest?” It’s set up as a sort of “heat map” that shows the total dollars invested across industries (the x-axis) and by various sized rounds (the y-axis). So, for example, $88 million was invested in Software companies with the round gross proceeds of less than $1 million (i.e. the top right box of the chart).

I was just playing around with another CompStudy data set and came up with the interesting chart at the right which I wanted to share. The chart attempts to answer the question, “where do tech VCs invest?” It’s set up as a sort of “heat map” that shows the total dollars invested across industries (the x-axis) and by various sized rounds (the y-axis). So, for example, $88 million was invested in Software companies with the round gross proceeds of less than $1 million (i.e. the top right box of the chart).

The data set is about 1,200 rounds of financing for US tech companies that completed the 2010 CompStudy survey. The total dollars represented by this sample is about $13 billion.

A few things jumped out at me:

- We all know that software companies get the lion’s share of dollars (about half), but it’s impressive to see how consistent the investing is from early stage $1-2 million rounds to late stage $10-15 million rounds.

- Hardware / semiconductors is stereotypically a capital intensive business, but the data suggest that more money is going into early stage deals than later stage deals. Not sure how to explain that.

- Cleantech looks to be less capital intensive than hardware and is nearly the same size as communications and digital media.

- IT services, as you would expect, doesn’t attract much investment capital.

Thoughts?

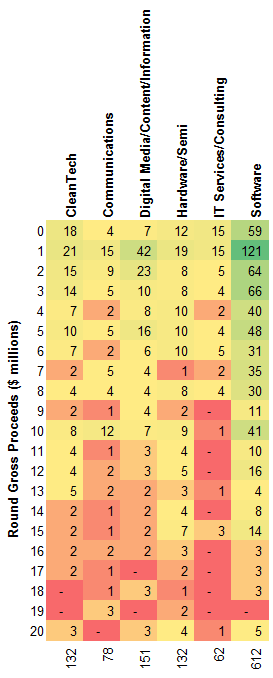

Someone asked about the number of deals in each segment and it turns out that I had created that heat map as well (see chart at the right).

Not surprisingly, software companies not only get half of the dollars invested, they also account for about half of the total deals. What’s interesting to note is how consistent the investing is (pretty much 52% of the pipeline of deals at each size are software companies.

Digital Media and Content companies garnered the second most in terms of number of investments, but in a world where more and more software is SaaS, these two industry sub-segments are blurring together.

11% of deals were Cleantech and most of those were early stage.