More on the “VC Math Problem”

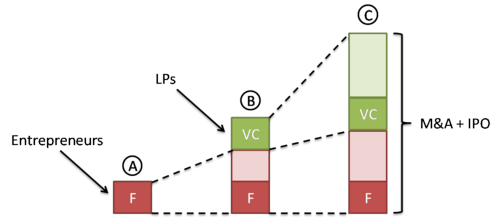

Fred Wilson started this thread with a couple of great posts on why the VC industry is having problems scaling. The real interesting part of Fred’s post is the volume and quality of comments. I’ve never seen such a focused (in time or topic) discussion that creates value. The bottom line take away (for me) is that VC is capacity limited by the value of exits (M&A plus IPOs). I’m a visual person so here’s how I see it:

Entrepreneurs start companies and the founders (“F” in my chart) invest capital which they grow with sweat equity and then limited partners (“LPs”) invest capital via VCs which in turn grows the pie to the eventual “exit” (which comes in the form of M&A or IPOs). In order to increase “A” or “B” you necessarily have to increase “C.”

According to Fred’s posts, the “math problem” in VC is that LPs have been investing capital in VC funds at the clip of about $25 billion per year for the past decade (excluding 1999 and 2000 which were strange years). But based on a bunch of different estimates of the “exit” market, it would seem to be that only justifies an investment by VC of about $10-15 billion annually…thus the “math problem.”

Over on TheFunded, there’s a thread which attempts to make the argument that VCs are bad “stock pickers” and that, in fact, the market could be 2X its current capacity if they were funding more companies. I’ve taken some heat over there for being skeptical of that claim. I’ll be the first to admit that I’m wrong….but show me the data!